Trying to interpret which way the economy will go is confusing and uncertain, even for those whose primary responsibility is doing so. There are many competing views on whether we’re in a recession and how long it will last. One thing we are confident in is that 2023 looks quite challenging.

After FMI Corporation analyzed the economic impacts for the engineering and construction (E&C) industry in its first paper, “How Bumpy Is It Going to Get? Mapping Recession Scenarios,” we argue now that the question isn’t whether the economy is in recession, but what the end of the downturn might look like, how policymakers will respond, and how long a recession might last. In that paper, we presented three potential recession scenarios:

- Base case — A correction lasting 12 to 18 months. In our most likely scenario, we outline the potential for tightening of monetary policy that will reinforce economic contraction as well as a large hit to the job market and asset prices resulting in 12 to 18 months of recession.

- Better case — A balanced correction lasting six to 12 months. In this case, inflation is expected to peak in 2022, followed by a decrease to below the five-year average toward the end of the year and into 2023, aided by a drop in oil prices. This allows real wages, savings and disposable incomes to rise.

- Worse case — Severe overcorrection lasting two to three years. Economic events as outlined in the base case become severe enough to create stimulative policy and other conditions for prolonged and higher inflation.

Using these three paths as a framework, we can better understand the underpinnings of this turbulent transition for the E&C industry. Also, given certain expectations and knowledge, it becomes possible to examine exposure to different scenarios, strategize for an era of repricing, and prepare to pivot and take advantage of shifts in the marketplace.

Yet, the recession and the eventual recovery will be uneven across E&C sectors, and we’re beginning to see that some will post growth, while others will see their business models shift drastically.

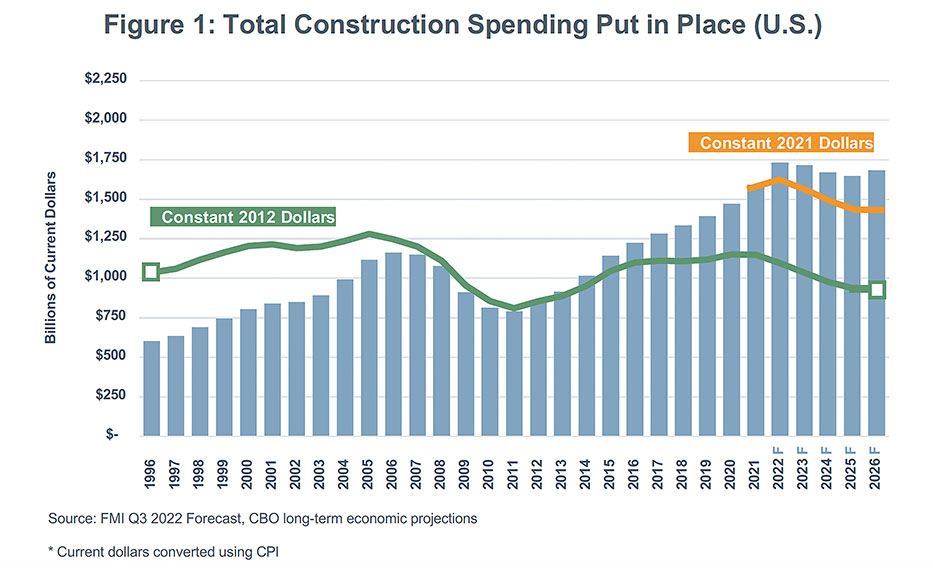

Adjusting for today’s inflation of about 8.5% (8.3% in August), real construction demand will seem like an almost 20% decline by 2026, despite the rise in total construction put in place spending. In 2012 dollars, construction spending remains below the 2005 peak and is almost 50% less than the current dollar forecast in five years.

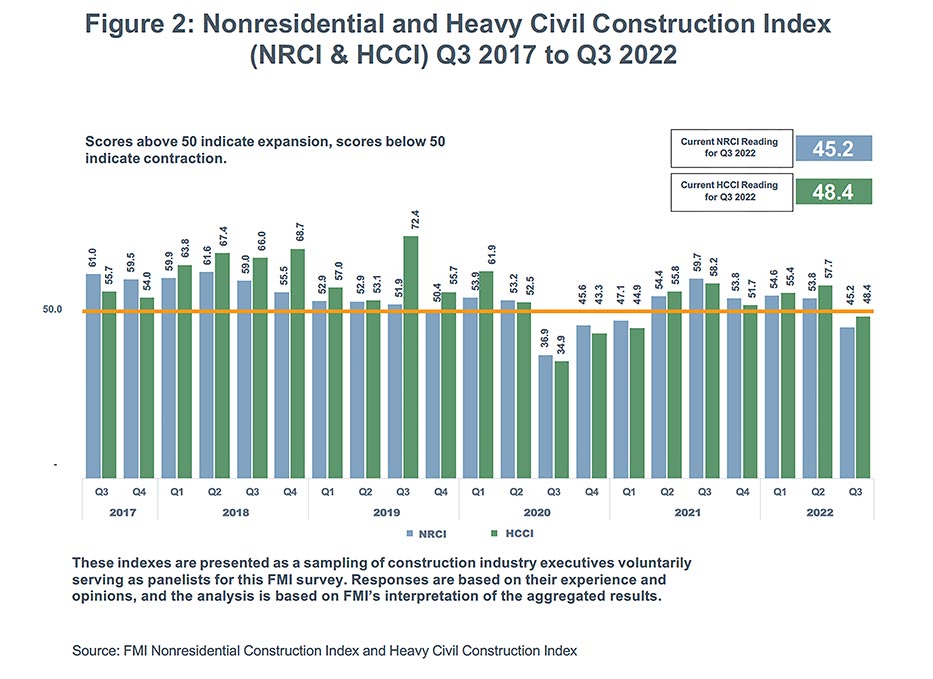

Given the current pressures, it’s not surprising that industry sentiment is declining across numerous sectors. FMI’s Nonresidential Construction Index (NRCI) and Heavy Civil Construction Index both declined 16% in the third quarter from the previous quarter. Both are showing that the industry expects contraction. The Construction Industry Round Table (CIRT) Sentiment Index dropped 20% quarter over quarter and 35% from the prior year’s third quarter.

While macro prognostications provide vital context, you need to zoom in to understand the dynamics of market sectors, which are often moving in different directions. So which areas will fare better through a recession, and which will contract?

Those sectors that have different demand drivers, that are larger than current economic activity, have increased developer interest and a time frame that’s longer than 12 months, or what we’re calling the new economy, will likely experience growth. Examples of this include data centers, life sciences, semiconductor fabrication and distributed power.

Places that encourage larger gatherings, like shopping malls, movie theaters, office space, sports facilities and amusement parks, are likely to experience a decline. Many of these places have taken a hit from the COVID-19 pandemic, combined with shifts in how people work and consume entertainment, and it is unlikely investment will return at the same levels.

Forecasting the exact behavior of spending across various segments or markets is tricky, but we can understand the possible impacts some of these larger trends will have in shaping the new economy in the coming years.

Some Bigger Trends to Focus On

- Urbanization — Eighty percent of the U.S. population lives in an urban area, which is shifting how people shop, eat and get around. For example, those consumers do most of their shopping online, driving demand for logistics, cold storage and last-mile delivery facilities. They’re farther away from food sources, and now 70% of U.S. daily caloric intake is processed foods, up from less than 50% in 2000. With nearly half of groceries purchased online, the need for distribution facilities and drivers continues to grow. And as car ownership becomes a larger expense, many are shifting to mass transportation options, driving demand for new ways to efficiently get around.

- Declining health — With 60% of U.S. adults on a daily prescription, the demand for life sciences and health care facilities continues to increase. Yet, our forecast of 2% growth in the next five years is tempered by the lack of staff for hospitals and other clinics despite the increase in demand.

- Growing data — The number of connected devices tripled in the past five years, adding to the growing need to store, process and analyze data, indicated by the more than 932 billion computer chips manufactured in 2020. Combine the increase in technology adoption with the shifting nature of work, with 50% of people working at home compared with only 5% pre-pandemic, and a 50% increase in data center spending in the next five years becomes clear.

- Power distribution — Extreme weather events have revealed weaknesses in U.S. energy infrastructure: Record outages in 2020 led to residents managing an average of 60 hours without power, and outages continue to impact communities across the nation. As the U.S. invests in power grid resiliency and renewables, green energy providers will be busy, especially when considering the likely forthcoming energy incentives found within the Inflation Reduction Act of 2022. Firms that retrofit and perform energy audits on old infrastructure will also find work in otherwise lagging sectors.

Construction spending is expected to mirror these key trends over the next five years. For example, data centers, which represent 20% of the office segment, are expected to increase by more than 50% in the next five years. Warehouses made up more than 50% of the commercial space in 2021, and spending here increased by 35% from 2019 to 2021, despite overall declines in commercial construction spending.

Additionally, no matter the current economic climate, long-running demographic trends and migration patterns highlight that Southern and Southeastern states will continue to offer favorable conditions for engineering and construction services. Those same patterns will allow newer and high-growth industries to flourish due to an inflow of labor, backed by local and state governments aggressively supporting business investments and relocations.

Conversely, however, these shifts impose considerable stress on other contracting markets (i.e., Western and Northeastern states), and challenges become amplified when the broader economy is in recession. Thinking of the economic climate as an accelerant for change imposes considerable risk on those states as their local economies evolve to become less diversified, more concentrated and increasingly dependent on their remaining employers. In those contracting states, labor is further constrained, which becomes a significant limiting factor for future economic growth.

Where you are in the next five years matters.

What Can E&C Firms Expect?

Given these trends, construction is getting bigger, faster and more complex. Projects are shifting from the small and ordinary to large megaprojects, with construction put in place for these expected to increase almost 500% over the next five years to $300 billion.

In 10 years, the U.S. megaprojects market is expected to reach $350 billion, according to FMI’s 2019 analysis.

With more than $3.5 trillion in megaprojects currently in design or planning phases through 2050 across North America, understanding the trends and market conditions where you operate will be critical to winning business, no matter the size of the contract. Increasing project complexity and size will require E&C firms to invest strategically to manage and deliver these large projects.

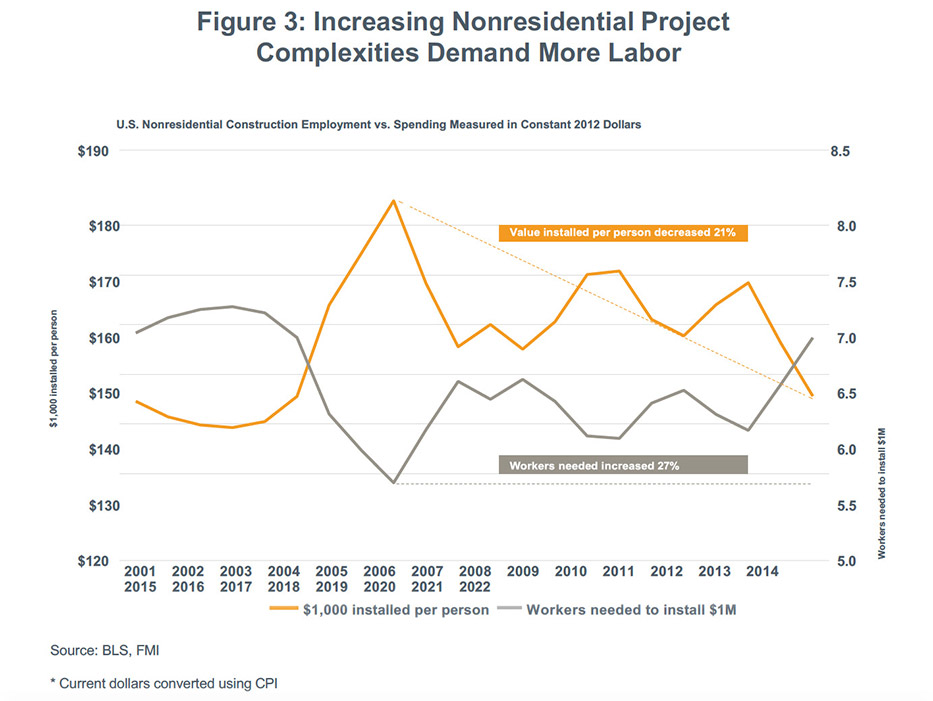

That investment will also need to include labor and productivity initiatives. Since 2009, the value of nonresidential construction installed per person has decreased 21%, while the workers needed to install $1 million of product has climbed 27% (Figure 3).

And projects aren’t just getting bigger. Their timelines are also condensing. For nonresidential projects valued at more than $25 million, the average schedule has shortened by more than a year during the past decade. That puts a strain on already challenged labor conditions as people are expected to do more in less time.

Understanding the broader economy and how that will impact your local business is critical for developing a strategy that will enable you to execute on projects in the new economy. Other ways to better position your company include:

- Understanding the customer.

- Recruiting the people currently in your organization.

- Leveraging your strengths to overcome obstacles.

- Developing scenarios based on sustained 10% to 15% increase in costs.

- Identifying opportunities to create competitive advantages.

- Building your network.

- Remembering what will be the same in the next five to 10 years.

While it’s not a time to panic, firms must be clear about the opportunities and their own competencies to best position themselves for success. Those that are unable to shift to work in the new economy risk being left behind.

Top 3 Takeaways

- Certain segments will continue to grow. Beware the changing risks on both sides.

- Understand the long-term demographics to position long-term opportunities.

- Project complexities and labor needs have been expanding. Is this trend sustainable?