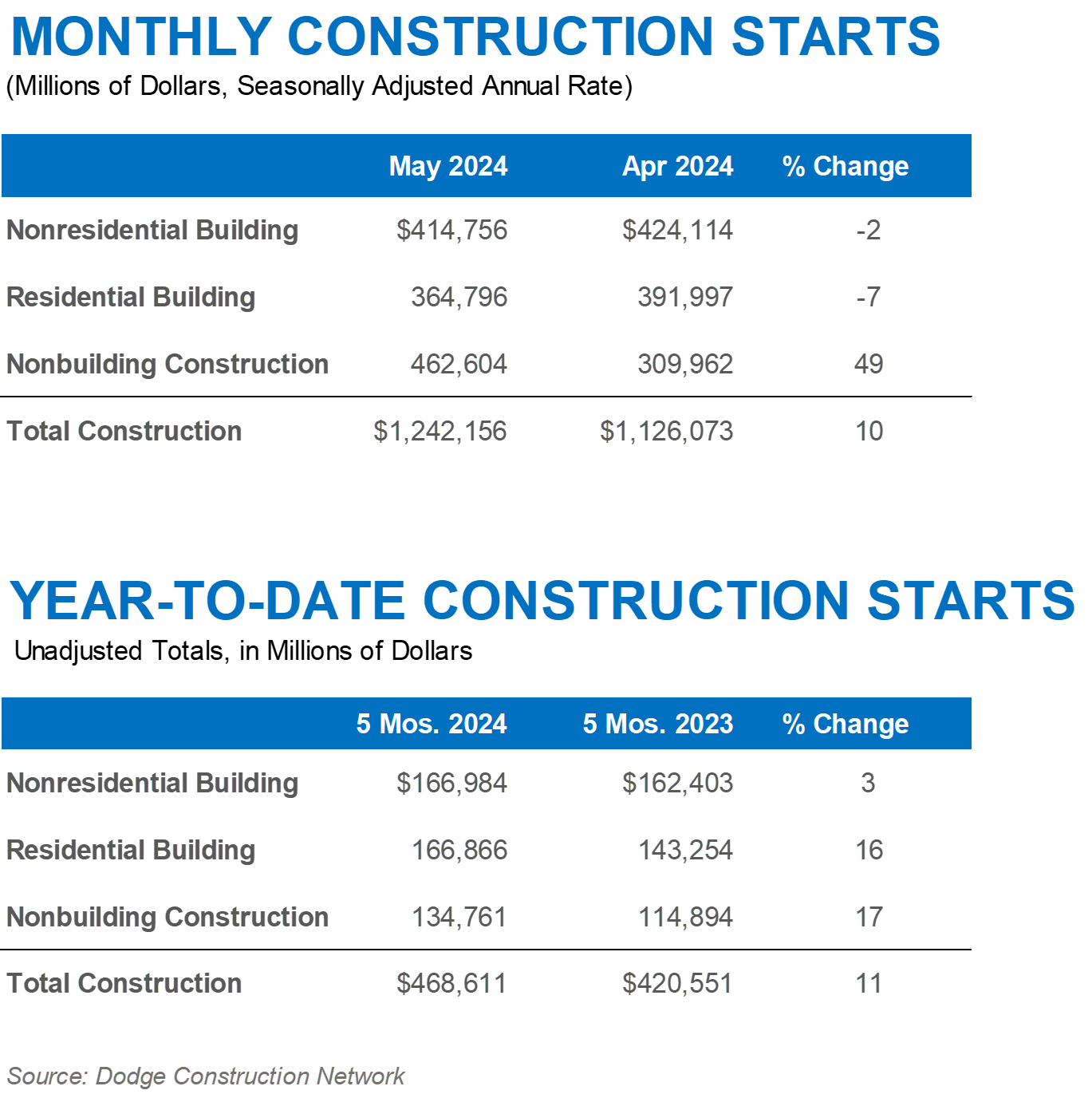

BEDFORD, Mass. (June 20, 2024) — Total construction starts rose 10% in May to a seasonally adjusted annual rate of $1.24 trillion, according to Dodge Construction Network. Nonbuilding starts gained an impressive 49% during the month, driven by the start of an offshore wind project and an LNG facility, while residential starts lost 7% and nonresidential building starts were down 2%. On a year-to-date basis through May, total construction starts were up 11% from the first five months of 2023. Residential starts were up 16%, while nonbuilding starts gained 17%, and nonresidential building starts rose 3%.

For the 12 months ending May 2024, total construction starts were up 2% from the 12 months ending May 2023. Nonresidential building starts were down 7%, residential starts were up 5%, and nonbuilding starts were up 14% on a 12-month rolling sum basis.

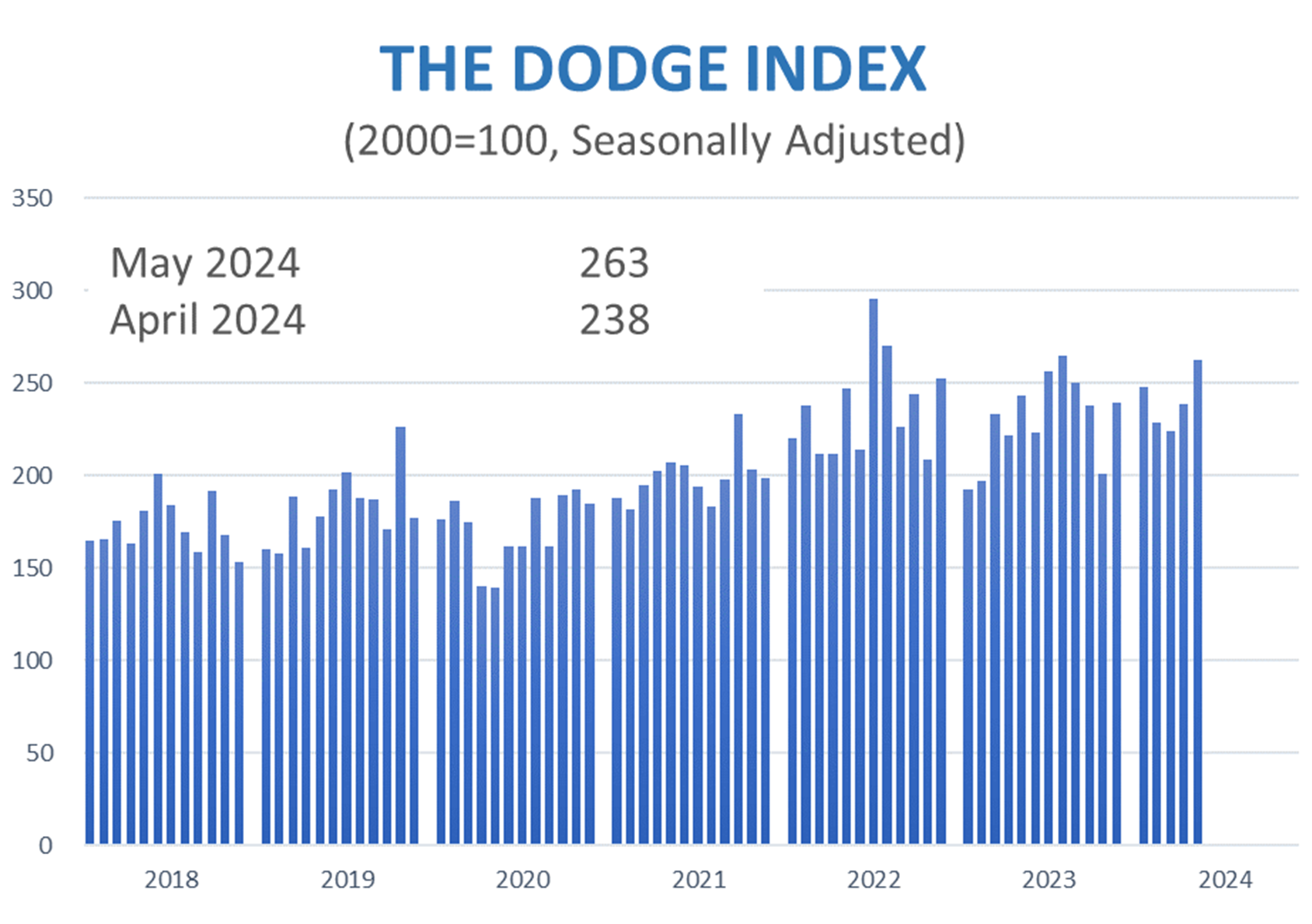

“Even though May’s gain in construction starts was mainly due to a handful of large projects, the data highlights that there is some grassroots demand building in the market,” said Richard Branch, chief economist of Dodge Construction Network. “Single-family starts, in particular, have risen in eight of the last 12 months despite high mortgage rates. Growth in single-family will incentivize further demand for retail, health and education starts, among others, and the stability in the Dodge Momentum Index, which tracks projects in planning, underscores this optimism.”

Nonbuilding

Nonbuilding construction starts rose 49% in May to a seasonally adjusted annual rate of $463 billion. The increase was solely on the back of a massive gain in gas/utility starts as two large projects (offshore wind and LNG) got underway. Environmental public works starts fell 10% and miscellaneous nonbuilding starts lost 16%, while highway and bridge starts were 22% lower in May. On a year-to-date basis through May, total nonbuilding starts were 17% higher. Gas/utility starts were up 35%, environmental public works and miscellaneous nonbuilding were each up 24%, and highway and bridge starts were up 3% on a year-to-date basis through May.

For the 12 months ending May 2024, total nonbuilding starts were 14% higher than the 12 months ending May 2023. Utility/gas starts were up 28%, miscellaneous nonbuilding starts rose 19%, environmental public works starts moved 14% higher, and highway and bridge starts rose 4% for the 12 months ending May 2024.

The largest nonbuilding projects to break ground in May were the $10 billion Dominion Energy offshore wind project off Virginia Beach, Virginia, the $11 billion trains 1 and 2 of the Port Arthur LNG project in Port Arthur, Texas, and the $1 billion Green River Energy Center in Emery County, Utah.

Nonresidential

Nonresidential building starts fell 2% in May to a seasonally adjusted annual rate of $415 billion. Manufacturing starts lost 14% following a very strong April, while institutional starts dropped 6%. Commercial starts gained 10% due to gains in warehouse, office, and parking starts. On a year-to-date basis through May, total nonresidential starts were up 3%. Institutional starts were 20% higher, while commercial starts were down 5%, and manufacturing starts were 19% lower on a year-to-date basis through May.

For the 12 months ending May 2024, nonresidential building starts were 7% lower than the previous 12 months. Manufacturing starts were down 32% and commercial starts were down 11%, while institutional starts were 10% higher for the 12 months ending May 2024.

The largest nonresidential building projects to break ground in May were the $2.1 billion Tennessee Titans Football Stadium in Nashville, Tennessee, the $1 billion Gotion EV Battery plant in Manteno, Illinois, and the $875 million General Motors Battery Cell factory in New Carlisle, Indiana.

Residential

Residential building starts moved 7% lower in May to a seasonally adjusted annual rate of $365 billion. Single-family starts rose 2%, while multifamily starts lost 25%. On a year-to-date basis through five months, total residential starts were 16% higher. Single-family starts improved 29%, and multifamily starts were 5% lower on a year-to-date basis.

For the 12 months ending May 2024, residential starts were 5% higher than the previous 12 months. Single-family starts were 15% higher, while multifamily starts were 10% lower on a 12-month rolling sum basis.

The largest multifamily structures to break ground in May were the $200 million The Atlantic Club in Long Branch building in Long Branch, New Jersey, the $150 million mixed-use project at 880 Atlantic Avenue in Prospect Heights, New York, and the $150 million Tuscany at Gabriella Pointe in Gilbert, Arizona.

Regionally, total construction starts in May rose in the Midwest, South Atlantic, and South Central regions but fell in the Northeast and West regions.