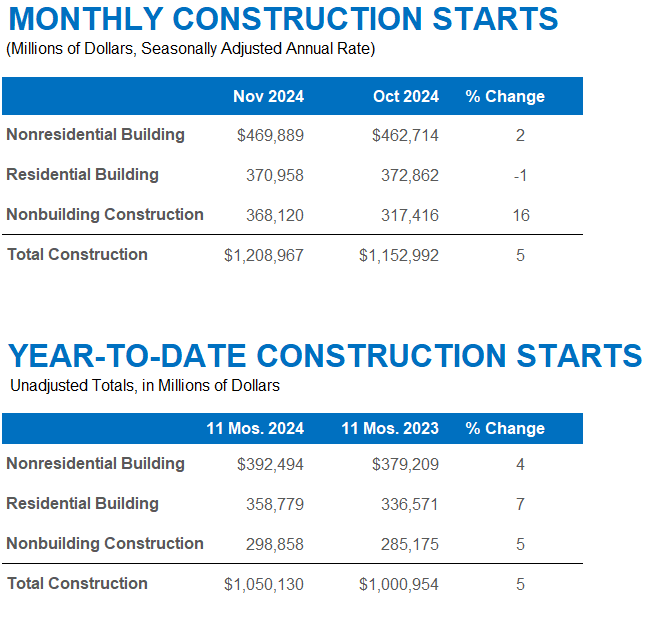

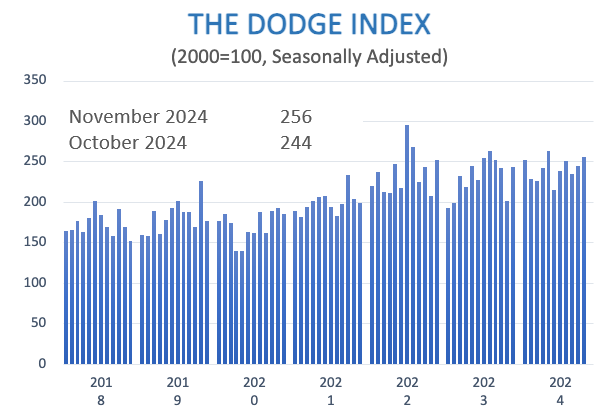

BEDFORD, Mass. (Dec. 19, 2024) — Total construction starts increased 5% in November to a seasonally adjusted annual rate of $1.2 trillion, according to Dodge Construction Network. Nonresidential building starts grew 2%, nonbuilding starts moved 16% higher, while residential building starts fell 1%. On a year-to-date basis through November, total construction starts were up 5% from the first 11 months of 2023. Nonresidential starts were up 4%, residential starts were up 7% and nonbuilding starts were up by 5%.

For the 12 months ending November 2024, total construction starts were up 4% from the 12 months ending November 2023. Residential starts were up 7%, nonresidential starts were up 2% and nonbuilding starts rose 4% over the same period.

“Construction starts continue to move sideways as the market waits for further rate cuts,” stated Richard Branch, chief economist of Dodge Construction Network. “Elevated interest rates, labor shortages, and strict lending standards will continue to constrain construction activity in the near term.”

Nonbuilding

Nonbuilding construction grew 16% in November to a seasonally adjusted annual rate of $368 billion. Environmental public works starts jumped 63%, while utility/gas starts moved 35% higher, and miscellaneous nonbuilding starts grew 3%. Highway and bridge starts fell 11% in November. On a year-to-date basis through November, total nonbuilding starts were 5% higher when compared to a year ago. Miscellaneous nonbuilding starts were up 27%, environmental public works starts were 16% higher, and highway and bridge starts improved by 6%, but utility/gas starts were down 16% through November.

For the 12 months ending November 2024, total nonbuilding starts were 4% higher than the 12 months ending November 2023. Miscellaneous nonbuilding starts were 27% higher, environmental public works gained 14%, highway and bridge starts increased by 6%, but utility/gas starts were down 18%.

The largest nonbuilding projects to break ground in November were a $2.9 billion Central Everglades Reservoir Embankment projects in Palm Beach County, Florida, the $2.0 billion Bahia NGL Pipeline across several counties in Texas, and the $1.4 billion SR 520, I-5 to Montlake bridge replacement in Seattle, Washington.

Nonresidential

Nonresidential building starts rose 2% in November to a seasonally adjusted annual rate of $470 billion. Commercial starts were 43% higher during the month thanks to an increase in data center, warehouse, and parking garage starts, while institutional starts fell 9% following a strong gain in October. Manufacturing starts, which posted a large gain in October, retreated, falling 52%. On a year-to-date basis through November, total nonresidential starts were up 4%. Institutional starts were 17% higher, while commercial starts were up 5%, and manufacturing starts were 33% lower on a year-to-date basis through November.

For the 12 months ending November 2024, nonresidential building starts were up 2% when compared to the previous 12 months. Manufacturing starts were down 40%, commercial starts were up 5%, and institutional starts were 18% higher for the 12 months ending November 2024.

The largest nonresidential building projects to break ground in November were the $3.4 billion Brooklyn Detention Facility in Boerum Hill, New York, the $1.4 billion AWS Amazon data center in Ridgeland, Mississippi, and the $750 million Frontier Scientific cold storage facility in Wilmington, North Carolina.

Residential

Residential building starts fell 1% in November to a seasonally adjusted annual rate of $371 billion. Single-family starts rose 5%, while multifamily starts were down 12%. On a year-to-date basis through 11 months, total residential starts were 7% higher. Single-family starts increased 15%, and multifamily starts were down 9% on a year-to-date basis.

For the 12 months ending November 2024, residential starts were 7% higher than the previous 12 months. Single-family starts were 16% higher, while multifamily starts were 9% lower on a 12-month rolling sum basis.

The largest multifamily structures to break ground in November were the $675 million Utopia Living apartments in Flushing, New York, the $312 million Calyer Place residential building in Greenpoint, New York, and the $235 million Hoboken Connect mixed-use development in Hoboken, NJ.

Regionally, total construction starts in November rose in the Northeast, South Atlantic, and West and South Central regions but fell in the Midwest.

Visit construction.com.