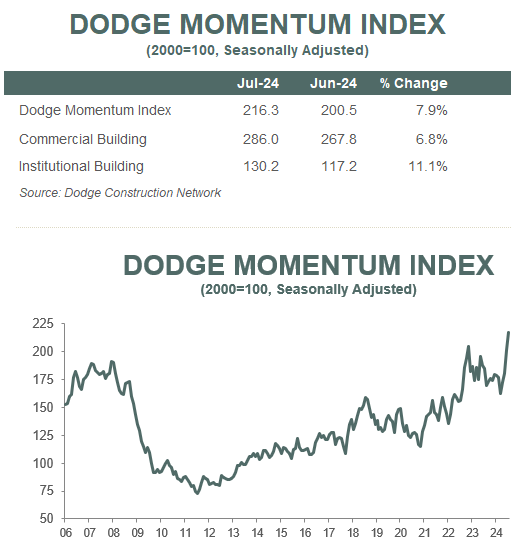

BEDFORD, Mass. (Aug. 7, 2024) — The Dodge Momentum Index (DMI), issued by Dodge Construction Network, increased 7.9% in July to 216.3 from the revised June reading of 200.5. Over the month, commercial planning increased by 6.8%, and institutional planning expanded by 11.1%.

“While data centers have had an outsized influence on nonresidential planning activity in recent months, more momentum is building across many other major sectors and diversifying the story behind July’s growth,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network. “The potential Fed rate cut in September is becoming increasingly more likely, alongside slower inflation and weaker labor market conditions. This is likely driving owners and developers to remain optimistic about 2025 market conditions and pushing more projects into the planning queue.”

Within the commercial portion of the Index, growth was widespread across all segments. Data centers continued to play an important role in growth, and retail planning has been steadily accelerating over the past eight months. On the institutional side, health care was the primary driver of this month’s expansion. In July, the DMI was 17% higher than in July of 2023. The commercial segment was up 35% from year-ago levels, while the institutional segment was down 14% over the same period.

A total of 23 projects valued at $100 million or more entered planning throughout July. The largest commercial projects included the $483 million Microsoft SAT82 Data Center in Castroville, Texas, and the $480 million Yorkville Data Center Campus in Little Rock Township, Illinois. The largest institutional projects to enter planning were the $325 million UCSF Children’s Hospital renovation in Oakland, California, and the $278 million Memorial Hermann Cypress Hospital expansion in Cypress, Texas.

The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year.

Watch Sarah Martin discuss July's DMI here.