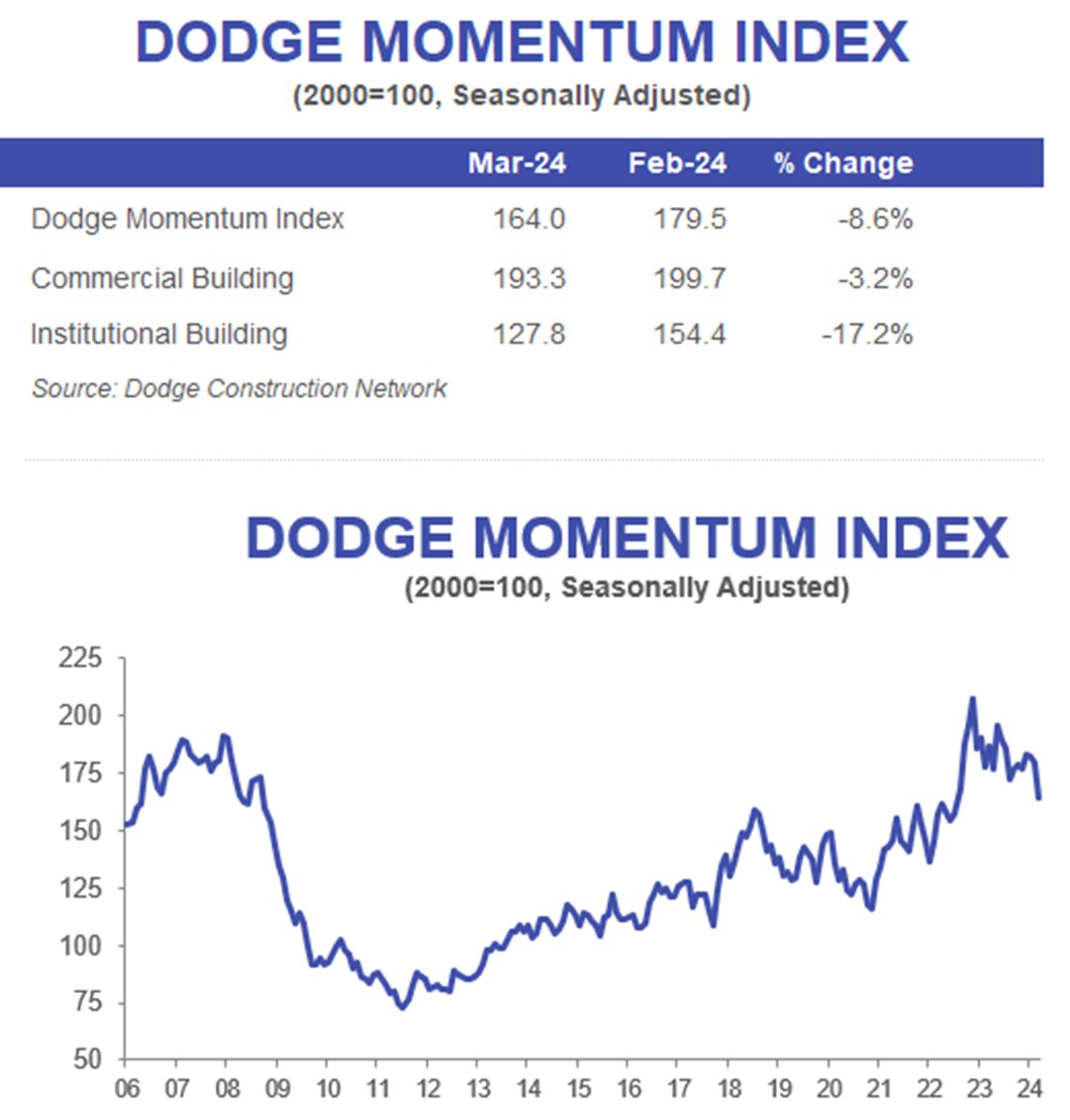

BEDFORD, Mass (April 5, 2024) — The Dodge Momentum Index (DMI), issued by Dodge Construction Network, fell 8.6% in March to 164.0 (2000=100) from the revised February reading of 179.5. Over the month, commercial planning fell 3.2% and institutional planning dropped 17.2%.

“In 2023, commercial planning decreased while institutional planning notably improved, sitting 29% above year-ago levels in February 2024. While strong market fundamentals should support institutional planning this year, this side of the Index is more at risk for a substantive correction after last year’s growth,” stated Sarah Martin, associate director of forecasting for Dodge Construction Network. “Much of the decline on the institutional side is credited to lower levels of education planning. Between February 2023 and February 2024, life science and R&D laboratory projects account for roughly 34% of education planning value, with that share reaching 59% in some months. In March, however, that share dropped to 7%. The surge of lab construction in recent years may lead to decreased planning demand as the market absorbs new supply in 2024. Likely, lower lab volumes will result in education planning returning to its long-run, and more sustainable, average.”

On the commercial side, slower growth in office and hotel planning pulled down this portion of the Index once again. Year over year, the DMI was 12% lower than in March 2023. The commercial segment was down 14% from year-ago levels, while the institutional segment was down 10% over the same period.

In March, a total of 14 projects valued at $100 million or more entered planning. The largest commercial projects included the $215 million Microsoft Data Center in San Antonio, Texas, and the $158 million Melrod Data Center Building B in Fredericksburg, Virginia. The largest institutional projects comprised the $277 million Trident Health Hospital in Johns Island, South Carolina, and the $220 million Sunset Amphitheater in McKinney, Texas.

The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year.

Watch Associate Director Sarah Martin Discuss March's DMI here.