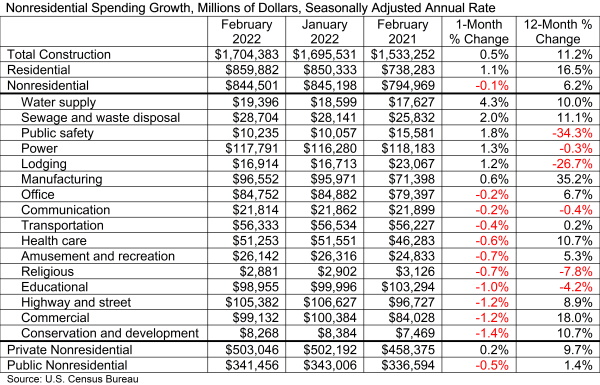

WASHINGTON (April 1, 2022)—National nonresidential construction spending was down 0.1% in February, according to an Associated Builders and Contractors (ABC) analysis of data published on April 1 by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $844.5 billion for the month.

Spending was down on a monthly basis in 10 of the 16 nonresidential subcategories. Private nonresidential spending was up by 0.2%, while public nonresidential construction spending was down 0.5% in February.

"Nonresidential spending decreased in February despite inflationary pressures that should have driven it higher," said ABC Chief Economist Anirban Basu. "True, nonresidential spending is up 6.2% year over year, but given the significance of construction materials inflation, spending has almost certainly declined in real terms.

"Moreover, the Russia-Ukraine war has spawned further materials price increases, which in turn raises the risk that project owners will decide to postpone or cancel projects,” said Basu. “ABC’s Construction Confidence Index indicates that a growing number of contractors expect to trim their margins during the year ahead in order to induce purchasers to continue to move forward. The spread of an omicron subvariant in China has started to interfere with production there, which translates to additional supply chain disruptions.

"As if that were not enough, the risk of recession is rising," said Basu. "While there is evidence of ongoing momentum, a recent increase in interest rates coupled with hawkish statements from the Federal Reserve imply that credit conditions will become more challenging this year. The question is whether the Federal Reserve can slow economic growth in order to counter inflation without driving the economy into recession.

“The recent inversion of the yield curve is viewed by many economists as a leading indicator of recession,” said Basu. “Since the early 1980s, most rate tightening cycles have ended in recession. For contractors that largely work on private construction projects, this suggests risk of weakening backlog at some point later this year or in 2023. For those largely focused on public work, the economics are more favorable, since federal infrastructure outlays will be elevated for approximately the next five years."