The United States construction industry is viewed as a key indicator of the strength of the American economy, consumer confidence and unemployment trends. As the unemployment rate declines, investment in both residential and commercial U.S. construction tends to increase, signaling improved consumer confidence and the spending that accompanies that confidence. This spending pumps money into the economy and creates demand for consumer goods and services, which eventually leads to investment in capacity increases in the commercial sector, such as manufacturing facilities, office space and retail establishments. We are now seven years removed from the start of The Great Recession in 2008, and although we have yet to see sustained momentum in gross domestic product (GDP) growth, which has ranged between +0.6 and +4.3 percent for four straight quarters through June 2015, the unemployment rate reached a seven-year low of 5.1 percent in August 2015 (remained unchanged for September 2015). This gradual economic recovery has provided the residential construction industry with +9 percent growth in 2015 and an expected growth of +8 to 9 percent in 2016. Nonresidential construction grew +7.1 percent through H1 2015, but is expected to only grow +5 percent for the full year, as contraction in power-related, water supply and public safety projects continue.

Cities Drive Regional Growth

The U.S. Census Bureau reports that there are 10 U.S. cities with 1 million or more residents. California and Texas alone contribute three cities each: Los Angeles, San Diego and San Jose for California and Houston, San Antonio and Dallas for Texas. These population estimates are based on the year-ended July 1, 2014, with results generally published about one year later. With the exception of New York City, which added the most residents last year, Texas led the category with its increase in housing units. Texas cities gained the most new units (+141,625), followed by California (+77,510), Florida (+67,208) and North Carolina (+39,855). However, given the nearly one-year information lag, additional factors are needed to accurately evaluate current and near-term trends. Construction job growth is published monthly by each U.S. state. Florida's figures provide a good example of the nationwide trend of strong, recent employment gains that have begun to slow dramatically this year. Looking back at June 2014, Florida added 2,260 jobs to support the 67,000 new housing units it added in the 2014 fiscal year. However, June 2015 saw a considerable slowdown in those job numbers, with Florida adding a meager 100 jobs.

Worker Shortages

A portion of the slowdown in hiring is explained by worker shortages across the country in this sector caused by construction worker flight. The housing crash that contributed to the recession forced many current and potential construction workers to leave the industry in search of other work or to leave the labor force altogether. Though the shortage is now causing a decline in hiring, it has bolstered overall employment figures in the industry. The Associated General Contractors of America (AGC) reported in July 2015 that construction employment totaled 6.38 million, the highest figure since March 2009, representing a +4.2 percent year-over-year increase. Unemployment in the construction sector had hit a peak of 27.1 percent in February 2010 but was down to 6.3 percent by the end of the first half of 2015. Political uncertainty played a part in the diminished labor force participation rate in the construction sector, as federal funding for transportation projects, such as highway and bridge repairs, earlier this year was low and unpredictable. The steep decline in crude oil prices is also a contributor, as projects in the energy sector have been cut back. Moody's Investors Service projected in Q1 2015 that oil exploration and production companies (E&Ps) would reduce capital expenditures by 41 percent in 2015, which we estimate will remove roughly $280 billion from the market.

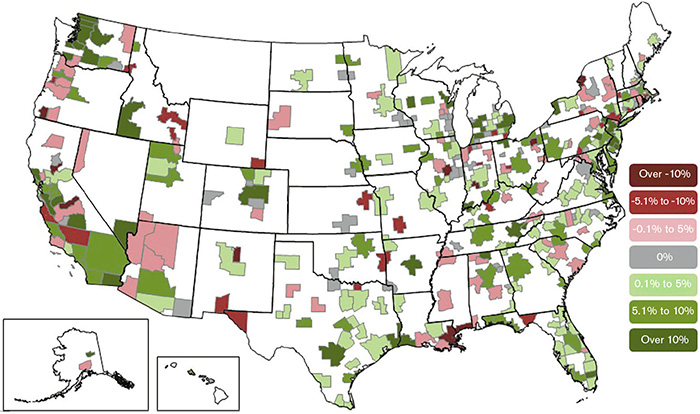

Figure 1. U.S. construction jobs growth

Source: The Associated General Contractors of America

Because construction trends are highly dependent on regional projects, they must be evaluated from a geographic perspective. Seattle added the most construction jobs between May 2014 and May 2015 at a rate of +15 percent (+11,300 jobs). New Orleans, however, recorded a -10 percent decline in construction jobs (-3,200 jobs) as new construction contracts declined by -89 percent to $107.6M in September 2014 versus September 2013, primarily due to a slowdown in nonresidential construction.

Headwinds Facing the Industry

Residential construction is expected to continue to grow between +7 percent and +8 percent through 2015 and 2016, with the potential for slightly lower growth and the possibility of higher interest rates. Interest rates have been kept near zero by the Federal Reserve System since December 2008. Millennials are one of the largest groups of potential homebuyers in 2015, and an increase in rates may further discourage these first-time homebuyers who are already faced with high down payment requirements, strict lending standards and high levels of student loan debt. Depressed demand for first-time home purchases limits the ability of their sellers to step up to their next home, which can have a domino effect. Furthermore, the pace of median rent growth of +4 percent has eclipsed median home value growth of +3 percent in 2015, which may further hinder buyers' ability to save for a down payment. Although the pace of home price growth has slowed from over +10 percent in 2013, data available as of Oct. 1, 2015, still reports a +4.7 percent trailing twelve months increase according to the S&P/Case-Shiller Home Price Index. This increase is mainly due to low mortgage rates and the expectation that rates will rise, given signals from the Fed for a potential interest rate hike in the coming year. As of Oct. 1, 2015, 30-year mortgage rates remain below 4 percent at an average of 3.85 percent. Higher rates will begin to slow the pace of home price growth in the next 12 months to +4 percent to +5 percent. Based on Trulia's analysis of median wages for an individual with a college degree saving 10 percent of wages annually towards a down payment, it would take more than 10 years to save for a home purchase in expensive cities such as Denver, Colorado, Portland, Oregon, or Oakland, California. Some relief may be found through new bank programs for first-time homebuyers that are beginning to surface. For example, TD Bank in Florida allows for down payments as low as 3 percent with no mortgage insurance to qualified buyers. Awareness of these programs remains low and banks report little traction thus far.

Nonresidential Construction Growth Revised Downward

A combination of headwinds has tempered the growth outlook in nonresidential construction. Growth in the near-term will be curbed by energy-related spending cuts precipitated by the roughly 50-percent decline in oil prices since June 2014 and new restrictive legislations affecting the coal industry. The growing construction worker shortage and minimal public sector growth of just +1 to +2 percent will also impact growth expectations. As a result, the full 2015 growth forecast for nonresidential construction is expected to soften from +8 percent to +5 percent. Depending on the oil price recovery, mid to upper single-digit growth for 2016 is likely.

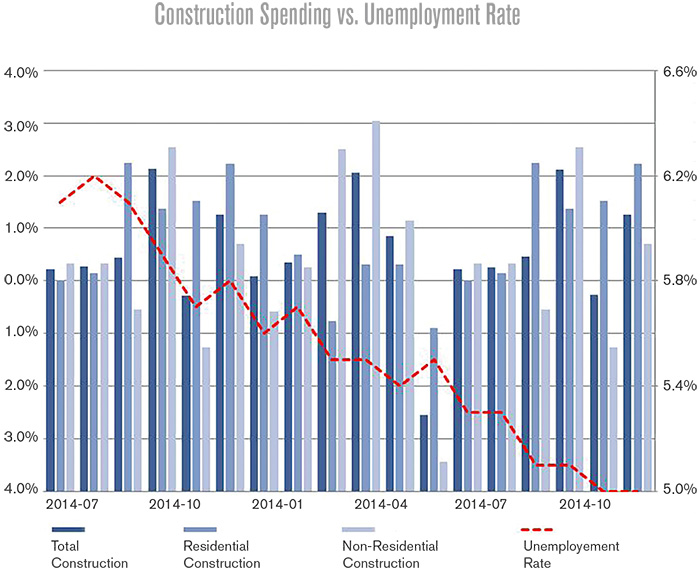

Figure 2. The growing construction worker shortage and minimal public sector growth of just 1 to 2 percent will also impact growth expectations.

Source: Euler Hermes, Bureau of Labor Statistics, forecast Euler Hermes

Increase in Building Permits in the Northeast

The Northeast held the lowest volume of new building permits by region in 2014 but surged +122 percent between July 2014 and June 2015 to 4.42 million. Meanwhile, the Midwest took the bottom spot, as it grew modestly at +7 percent. The Southern and Western regions nearly grew in tandem at +13 percent and +11 percent, respectively. The Northeast region's growth in new building permits signals a significant opportunity for the building materials sector, potentially tempered by the looming shortage of construction labor. Total construction spending has increased +13.7 percent for the similar time period, slightly lower than the +15.5 percent growth in new building permits, which may be partially explained by the skilled labor shortage.