Learn why LEED certification is gaining importance not only for government contracts, but for private projects, too.

The green construction trend is one growth area for construction that has not been completely sidelined during the recession. In fact, the majority of contractors are continuing to see robust demand for green construction in their backlogs, even if those backlogs are down.

In the first quarter of 2008, FMI's quarterly Nonresidential Construction Index (NRCI) survey asked contractors what portion of their backlog they expected would be considered "green construction" by 2011. Results showed that contractors expected green construction projects to represent 38 percent of their backlogs, up from only 13 percent at the time. Currently, FMI predicts that total U.S. green construction put in place will increase from $19.1 billion in 2009 to $22.9 billion in 2013. While the whole pie of construction is getting smaller, green construction is taking a bigger piece. In 2002, green construction represented 1 percent of U.S. total nonresidential construction put in place, but by 2013 this is predicted to increase to 5.5 percent. As a result, the U.S. construction market may be a bit darker but also a bit greener.

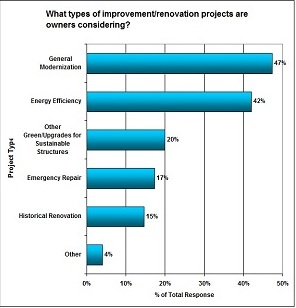

In the third quarter of 2010, FMI Nonresidential Construction Index, we reported that NRCI panelists have seen a slight increase in improvements and alterations projects in their backlogs and expect to see an increase in these projects from 20 percent of backlog now to around 25 percent over the next three years. The largest percentage of these projects is for general building modernizations (47 percent), but a significant amount is dedicated to energy efficiency (42 percent) and green or sustainable building improvements (20 percent). We asked panelists if they had seen an increase in improvements and alterations projects, because we suspected that, although owners are delaying new construction, they might be channeling some of their efforts and investments into maintaining and upgrading existing structures. At this point, the trend does not seem to be very robust, but it is significant in a market where contractors need to broaden their market scope and find work wherever they can.

In the third quarter of 2010, FMI Nonresidential Construction Index, we reported that NRCI panelists have seen a slight increase in improvements and alterations projects in their backlogs and expect to see an increase in these projects from 20 percent of backlog now to around 25 percent over the next three years. The largest percentage of these projects is for general building modernizations (47 percent), but a significant amount is dedicated to energy efficiency (42 percent) and green or sustainable building improvements (20 percent). We asked panelists if they had seen an increase in improvements and alterations projects, because we suspected that, although owners are delaying new construction, they might be channeling some of their efforts and investments into maintaining and upgrading existing structures. At this point, the trend does not seem to be very robust, but it is significant in a market where contractors need to broaden their market scope and find work wherever they can.

In 2008, several contractors still that felt green construction was more fad and market hype than a significant trend. Some were reluctantly beginning to learn more about the subject, so they could answer owner's questions and bid on green projects, expecting that the extra cost of going green would keep the trend in check. Most embraced green construction and were preparing their companies to get ahead of the curve. As one contractor remarked at the time, "We need to get LEED certified in a hurry." In the last few years, most contractors have heeded the call to "go green" and become Leadership in Energy and Environmental Design (LEED) certified.

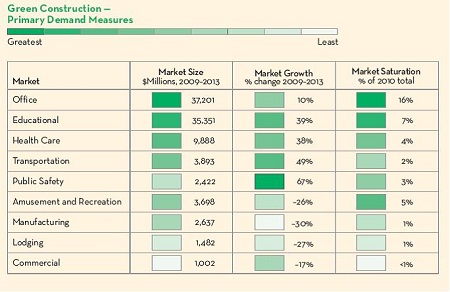

The urgency to become a certified and knowledgeable contractor for green and sustainable construction practices is driven in large part by the requirements of all federal and a growing number of state contracts to employ green construction methods and materials for all new and improvement/alterations projects. Green construction and LEED certification is of growing importance for private owners, too. The markets that have a stronger opportunity for green construction include office, educational and health care, while those just starting to incorporate green building practices include commercial, lodging and manufacturing.

While LEED-certified buildings can be found in every state and more than 400 cities across the U.S., green construction is still highly concentrated in larger, urban and more progressive states and metros. States such as California, Oregon, Washington and Pennsylvania have the most LEED-certified buildings and are considered to be on the forefront of the green building movement.

While LEED-certified buildings can be found in every state and more than 400 cities across the U.S., green construction is still highly concentrated in larger, urban and more progressive states and metros. States such as California, Oregon, Washington and Pennsylvania have the most LEED-certified buildings and are considered to be on the forefront of the green building movement.

As funding from the American Recovery and Reinvestment Act (ARRA) state stabilization fund is being directed and distributed to schools, more government dollars than ever will soon be available for schools to make much needed green improvements and implement green building practices. K-12 school districts in large metropolitan areas, such as New York City, Los Angeles, Chicago and Philadelphia are already committed to green standards for new construction and major renovations and will have little difficulty utilizing these federal funds.

While government funding has been a primary driver of new green construction in the K-12 educational market, it is definitely not the only driving factor. A growing number of school districts are looking to retrofit existing buildings. Increasingly, K-12 school districts are partnering with energy services companies (ESCOs) to do performance contracting, which offers a means of financing energy upgrades with the projected energy cost savings.

With new construction slowed down, retrofits of existing buildings can help school districts reap the highest return on their investments. An increasing number of educational owners understand the benefits of building green and are now looking for construction partners to assist with the implementation of innovative green building practices.

Kevin Haynes is a consultant with FMI's Research Services Group, and provides a broad range of services to clients nationwide, including contractors, building product manufacturers, construction material producers and suppliers and industry related associations. Kevin's primary responsibilities include the management and execution of research projects, involving primary and secondary research methods.

Phil Warner is a research consultant with FMI, management consultants and investment bankers to the construction industry. He specializes in construction industry market research and manages FMI's Nonresidential Construction Index survey. In his nine years at FMI, he has conducted research and produced reports on a number of economic and management issues for the construction industry including business development, productivity, strategy, owner practices, industry ethics and successful contractors.

Construction Business Owner, December 2010