Most contractors are well aware that a combination of issues can create problems on any construction project.

There could be financial changes in the economy, unforeseen changes in jobsite conditions, a death or illness of a key employee, rising interest rates on a bank loan, oil and materials price increases, subcontractor problems, inclement weather …. The list goes on and on.

There could be financial changes in the economy, unforeseen changes in jobsite conditions, a death or illness of a key employee, rising interest rates on a bank loan, oil and materials price increases, subcontractor problems, inclement weather …. The list goes on and on.

So how can contractors position themselves to handle those risks that cannot be controlled and avoid those risks that can? Many contractors rely on surety underwriters and professional surety bond producers for their vast experience and valuable resources to avoid extreme risks and overcome challenges.

Risky Business

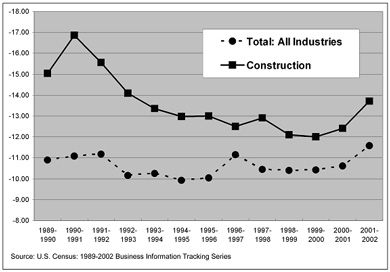

Because of the interdependent nature of construction, construction companies have a higher failure rate than many other types of companies. Looking at U.S. Census data from 1989 to 2002, the average rate of failure in the U.S. construction industry is almost 14 percent, while the average rate of failure for all industries is under 12 percent.

Average Rate of Failure

Contractor default is an unfortunate and sometimes unavoidable circumstance. According to BizMiner, an industry analysis provider, of the 850,029 non-single family building, heavy/highway, industrial building, warehouses, hotel/motel, multifamily housing and specialty trade contractors operating in 2004, only 649,602 were still in business in 2006—a 23.6 percent failure rate. Construction companies that have been in business less than one year had an even higher failure rate of 36.8 percent.

Even companies that have been in business for fifty years can fail. History has proven that old companies can fail just like new ones, and even good people can experience a business failure.

According to the U.S. Census:

- Very small firms (1 to 4 employees) have the highest failure rate

- Firms with 20 to 499 employees have the lowest failure rate

- Firms with 500 or more employees have a failure rate that falls in between the very small and medium firms

Cost of Failure

So who pays when a contractor fails? On unbonded projects, the taxpayer, construction project owner or lender does. When a project is protected with a performance and payment bond, the surety industry pays for project completion. The Surety & Fidelity Association of America (SFAA) reports that sureties have paid more than $10 billion on contract bond claims since 1992.

Causes of Failure

There are many reasons for contractor failure, and they all boil down to risk. Grant Thornton’s report “2005 Surety Credit Survey for Construction Contractors: The Bond Producer’s Perspective” cited low profit margins, followed by slow collections and insufficient capital as the major causes of financial difficulties among contractors. Surety company executives also have named onerous contracts, unreasonable owners, bad or incomplete plans, tight completion schedules, consequential damages, delay damages, and hold-harmless obligations, higher materials prices, and a shortage of qualified and skilled workers as factors that add risk and can ultimately lead to financial difficulties and default.

Additional contractor failure risks include:

- Not bonding subcontractors, where the general contractor assumes he or she can pre-qualify subs and forgo the protection of the bond

- Intangible or uncontrollable work environment issues such as inclement weather, unidentified poor site conditions, inflation, material and equipment shortages, and unexpected economic events such as the Gulf Coast disaster

Overexpansion, whether a change in the type or size of work performed or a move into a new geographic area, is another leading cause of contractor failure. Problems with accounting, management, personnel and performance can all turn “good growth” into unrealistic growth. Accounting and financial management problems include:

- Inadequate cost tracking systems, debt burden, poor cash management, undercapitalization

- Estimating or procurement problems

- A lack of adequate insurance

- Improper accounting practices (not adhering to the American Institute of CPAs’ Audit Guide for Construction Contractors)

The loss of loyal customers is another sign the contractor may be in trouble. When loyal customers look elsewhere, it is a sign of a decreasing reputation for the company’s ability to perform contracts on time and within budget.

When it comes to thriving in today’s booming construction market, it pays to have a good relationship with a professional surety bond producer and surety underwriter. These surety professionals are well-positioned to analyze and manage construction risks because of their close relationship with contractors. These surety professionals can be a contractor’s best ally when problems loom. The most important thing a contractor can do is keep the surety informed when problems arise. Communicate good and bad news to the professional surety bond producer and surety underwriter if or when problems begin. Many surety companies will work with the contractor to help him or her through the problem if possible.

A final word of advice:

- Understand the surety’s rights and responsibilities

- Stay within capabilities

- Manage growth and control overhead

- Learn the causes and warning signs of contractor failure

Construction Business Owner, May 2007