If you are a commercial construction business owner planning your bids for spring and summer of 2018, controlling fuel expenses for your fleet is a major consideration. Based on the laws of supply and demand, the variability of diesel fuel costs is driven by a range of factors, from regional and global events to Mother Nature. How do construction businesses stay profitable when one of the largest expenses—fuel—is a moving target?

Bidding on jobs can be a great budgetary risk, especially in the private sector, where adjustments for diesel fuel price fluctuations are not granted. Public projects, or those controlled by state and federal government, come with a price adjustment clause, and fuel is most often based off the Oil Price Information Service (OPIS) index. OPIS publishes fuel price information on a daily basis for all major United States markets. The OPIS index program allows you to tie your price to the going rate in your market as defined by OPIS. You pay a fixed differential over or under the OPIS reference price you establish. If you are looking to assure that you are buying as close to the local market price as possible, consider this program.

On the other hand, private construction projects are based on a fixed price. Careful budgeting is critical no matter the type of job, though private jobs often come with higher exposure and risk. A fixed price program assures availability of supply at a set price for a set period of time. By knowing what your fuel price will be in advance, you can budget effectively, protect margins and bid on new business with confidence.

There are a number of factors to consider when planning commercial construction bids for the next year. By keeping a pulse on these key influencers, construction business owners can save time and gain more control over their fuel expenses to make more competitive bids.

1. Keep an Eye on OPEC

The influence of the Organization of the Petroleum Exporting Countries (OPEC) on global oil prices is undeniable. As of August 2017, the organization is made up of 14 oil-exporting Member Countries that have major impact on the petroleum policies that drive what the world pays for oil. When the value of crude oil is low, OPEC may cut production to drive up prices. In November 2016, OPEC and key non-OPEC producers (Russia) announced crude production cuts of 1.8m barrels per day (bpd), or about 2 percent of the world’s production, in an effort to stimulate price increases, according to The Economist. However, not all members comply with these cuts, making it even more difficult to predict which direction oil prices will go. Yet, OPEC isn’t the only factor in the crude price wars.

Bottom line: OPEC drives a large part of the world’s oil supply/pricing. Follow OPEC’s Monthly Oil Market Report for major issues affecting the world oil market.

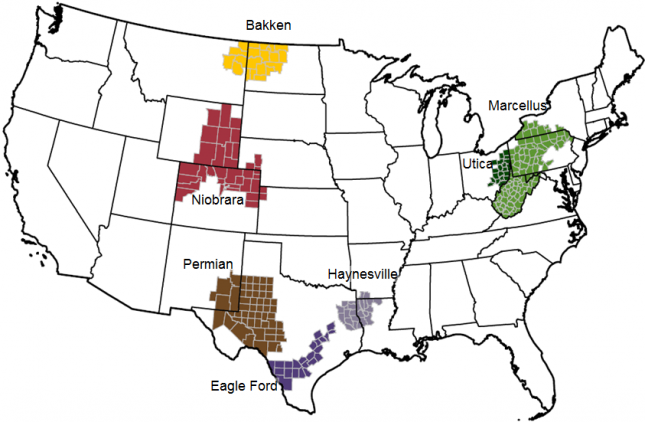

U.S. shale production across several oil-rich basins is keeping pressure on OPEC. Source: CNBC

2. Follow U.S. Shale Production

The U.S. Department of Energy has forecasted U.S. oil production will rise to 10 million bpd in 2018, the highest annual level in history. This rise should strengthen OPEC’s commitment to production cuts as the market recedes because of U.S. production. Market analysts observe specific patterns: As the crude market goes up, so does U.S. production. Each time OPEC threatens cuts, the market goes up. As U.S. shale production rises, the market goes down.

The US Department of Energy has forecasted U.S. oil production will rise to 10 million bpd in 2018. Source: CNBC

At publication time, the global market is on a downward swing, with NYMEX HO prices, the main trading benchmark for distillates, hovering between a resistance level of $1.62 and a support level of $1.40 per gallon for the majority of 2017.

The 2017 global market is on a downward swing, with NYMEX HO prices hovering between $1.62 and $1.40 per gallon. Source: Thomson Reuters Eikon

Bottom line: The U.S. and OPEC production is interrelated and creates constant global market variability. One way to see how markets are responding is to follow CME Group heating oil charts. These numbers align with diesel fuel prices and give owners a better understanding of trends. You can also follow the International Energy Agency (IEA) Oil Market Report.

3. Beware of Seasonal Changes

During cold winter months and storm seasons, the price of crude can rise dramatically as demand increases. Fuel costs will vary by region, and inclement weather can also interrupt operations and your fuel needs. Higher demand brings more volatility to local fuel markets and greater risk to construction bid planning.

Bottom line: Consider your job timeline and be prepared for weather-related fuel price increases. Pay attention to weather trends and their effects on the fuel markets, especially if the job your company is bidding for is in an area that experiences extreme weather conditions.

4. Monitor Daily World News

In addition to natural influences, humans also have a significant power to affect the world oil market. When international tensions rise, wars break out or political unrest ensues, the market reacts. The cyclical nature of oil values and global conflict has been an issue for decades. Unrest in Libya and Venezuela—both oil-producing countries—is causing turbulence in the market, as of August 2017.

Bottom line: As we all know, the world can change in a moment. Stay up to date on world events, especially in the U.S. and OPEC Member Companies. Oil markets are a complex web of interconnected influencers.

Properly estimating and controlling fuel budgets to prepare for a commercial construction bid—whether it be a public or private job—requires that planners have an understanding of how oil prices are affected. By staying informed on markets and world influencers, owners can make more accurate fuel budget estimates for their fleets and increase their profitability.